Why us?

HYUNDAI Finance ist ein Geschäftsbereich der im Oktober 2016 neu gegründeten Hyundai Capital Bank Europe GmbH mit Sitz in Frankfurt am Main. Wir sind die europäische Tochtergesellschaft der südkoreanischen Hyundai Capital Services Inc. in Seoul. Mit über 10.000 Mitarbeitern weltweit ist unser Unternehmen Marktführer im Bereich Finanzierung und Leasing von Hyundai und Kia Fahrzeugen. Wir konzentrieren uns nun darauf, die neue Automobilbank für die Marken Hyundai und Kia in Deutschland zu etablieren. Aus diesem Grund suchen wir nach hochmotivierten Mitarbeitern, die bereit sind, diese Herausforderung anzunehmen, um das bereits Geschaffene begeistert weiterzuentwickeln. Sie haben die einzigartige Chance in einem innovativen Unternehmen mit einer außergewöhnlichen Unternehmenskultur Ihre Ideen in unser schnell wachsendes Geschäft einzubringen und umzusetzen. Das alles in einer internationalen Arbeitsatmosphäre im Herzen der deutschen Bankenmetropole. Exciting, Opportunities – Join us!

Our Culture

Die Hyundai Capital Bank Europe GmbH entwickelt sich im Geschäftsbereich KIA Finance sehr positiv. Diese Dynamik verstehen wir als Chance uns ständig weiterzuentwickeln. Wir fördern die Zusammenarbeit und jeder einzelne Mitarbeiter spielt eine wichtige Rolle in der Wahrnehmung unserer Unternehmensphilosophie- und werte. Diese helfen uns, den Kunden in den Mittelpunkt unseres täglichen Handelns zu stellen.

- Alle

- Sales

- Corporate Services

- Development & Training

Für die Hyundai Capital Bank Europe GmbH stehen die Mitarbeiter im Mittelpunkt. Die Stärken der Mitarbeiter werden gezielt gefördert und weiter ausgebaut. Damit können wir eine kontinuierliche, persönliche und fachliche Weiterentwicklung gewährleisten. Denn nur mit leistungsfähigen, motivierten Mitarbeitern kann unsere Bank weiter wachsen. Unser jährlicher Performance Management Prozess fördert eine individuelle Karriereentwicklung und bietet unseren Mitarbeitern die Chance und Flexibilität innerhalb unseres Unternehmens weiter voranzukommen.

Training & Workshops

Unsere Mitarbeiter können ganzjährig an zahlreichen Workshops und / oder Schulungen zu verschiedenen Themen teilnehmen, um sich kontinuierlich persönlich und fachlich weiterzuentwickeln. Dadurch werden gezielt die persönlichen sowie fachlichen Stärken der Mitarbeiter gefördert und stellt somit einen großen Mehrwert für unser Unternehmen dar.

- Company Benefits

Neben einem für die Position entsprechend attraktiven Jahresgehalt profitieren unsere Mitarbeiter von zusätzlichen Leistungen:

- Flexible Arbeitszeiten

- Leistungsgerechte Bezahlung

- Betriebliche Altersvorsorge

- Angenehme Arbeitsatmosphäre in einem internationalen Team

- Moderner Arbeitsplatz im Herzen der Bankmetropole Frankfurt am Main

- Ideale Verkehrsanbindung

- Lunch vouchers

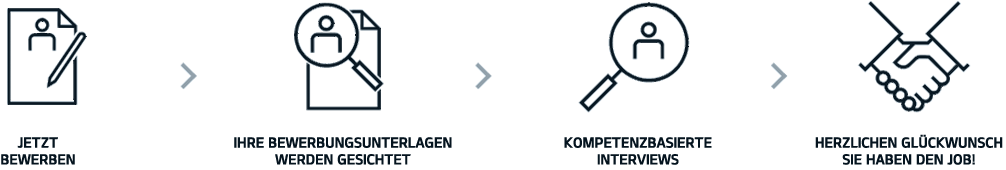

- Sind Sie interessiert bei der Hyundai Capital Bank Europe GmbH zu arbeiten?

Wir freuen uns auf Ihre Bewerbung. Bitte geben Sie dabei ebenfalls Ihre Kündigungsfrist sowie Gehaltserwatungen an .

Wie wir mit Ihren Bewerberdaten umgehen, erfahren Sie hier.